Law no. was published in the Official Monitor. 247 of July 31, 2023 for the amendment Law no. 1540/1998 regarding the payment for environmental pollution and which enters into force from 01.10.2023

IMPORTANT!

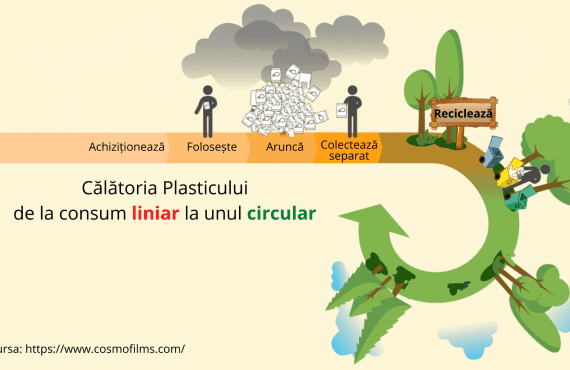

1. New tariff headings have been introduced, which according to the Combined Nomenclature of Goods represent packaging made of paper, cardboard, plastic, glass and which will be subject to packaging tax.

Art. 11, paragraph (4). The tax rate for goods that cause environmental pollution in the process of use is established as follows:

| Tariff item code | Packaging material | Tax rate on packaging (lei/ton) |

| 3923 | Plastic | 4500 lei |

| 4415 | Wood | 1400 lei |

| 4819 | Paper and cardboard | 1000 lei |

| 7010 | Glass | 2000 lei |

| 7310, 7311 00, 7606 12, 7612 7613 00 000 | Metals (including aluminum) | 1400 lei |

| Composite | 1000 lei |

2. The mechanism for exempting those economic agents who recover and recycle the packaging placed on the market from the packaging tax was regulated. Producers registered in the SIA-MD will benefit from an exemption from the tax on packaging equal to the ratio between the amount of recovered waste and the amount of waste that corresponds to the recovery objective set out in annex no. 2 of HG 561/2020 for the approval of the Regulation on packaging and packaging waste, multiplied by the packaging tax.

Art. 11, para. (7) Subjects who have reached the recovery objective are exempt from paying the packaging tax. Subjects registered in the SIA-MD benefit from an exemption from the packaging tax equal to the ratio between the amount of recovered waste and the amount of waste that corresponds to the recovery objective provided for in annex no. 2 to Government Decision no. 561/2020, multiplied by the tax rate on packaging provided for in para. (4) point 2), as follows:

Tf = Tand − (V/O × Tand),

in which:

Tf - the amount of the tax to be paid;

Tand - the rate of tax on packaging provided for in paragraph (4) point 2);

V – the amount of recycled waste;

O – the amount of waste that corresponds to the recovery objective provided for in annex no. 2 to Government Decision no. 561/2020."

3. Calculation of packaging tax according to weight but not based on the number of packaging units. Thus, the tax rate for packaging will be established in absolute amount at a unit of measurement of the weight of the material from which the packaging is made (plastic, wood, paper, cardboard, glass, metals (including aluminum) and/or composite).

CAREFUL!

For the year 2023, the recovery objectives will be calculated based on the amount of packaging that will be made available on the market starting from the date of entry into force of the new law.